Vial: Reimagining Clinical Trials

Act I and Act II of Vial's vision to transform first-in-human trials

Welcome to The Century of Biology! This newsletter explores data, companies, and ideas from the frontier of biology. You can subscribe for free to have the next post delivered to your inbox:

Enjoy! 🧬

When Mark Zuckerberg and Priscilla Chan announced their philanthropic efforts to “cure, prevent, or manage all diseases by the end of the century” in 2016, they were ridiculed. Skeptical scientists leaned back from their lab benches and groaned collectively. More tech money attached to bold and vacuous claims. The prevailing sentiment seemed to be: “Biology is hard. Good luck!”

In reality, how outlandish is this claim? It’s now been seventy years since the discovery of the double helical structure of DNA—one of the most iconic and widely recognized images in the history of science. Since then, we’ve invented absurdly cheap tools for digitizing, writing, amplifying, and editing DNA.

Our newfound ability to manipulate nucleic acids has already had remarkable consequences. We’ve developed the basic prototype for how to genetically engineer our own immune cells to cure cancer and designed nucleic acid vaccines in a matter of hours during the COVID pandemic. What else will we have accomplished by 2053, the one-hundredth anniversary of the double helix?

If we don’t think we can genuinely make a dent in treating nearly all diseases by the end of this century, we aren’t taking ourselves seriously. There are still enormous challenges to tackle, like inventing new drug delivery approaches and solving the manufacturing bottleneck for medicines, but this is where great scientists and engineers shine. A broader problem looms:

Do we have the infrastructure to test all of the new medicines we’re inventing?

As the cost of sequencing DNA has plummeted, we’ve seen the exact opposite phenomenon for the cost of making new drugs. This trend is so distinct that there’s a name for it: Eroom’s law, the inverse of Moore’s law. One of the primary reasons for this is that clinical trials—the randomized experiments where new medicines are first tested in humans—have ballooned in cost. While the cost per patient used to be as low as $10,000 in trials, it can now be as high as $500,000.

This is precisely the problem that Simon Burns and the team at Vial seek to tackle.

Vial is inventing new technology with the goal of reducing the cost of clinical trials by an order of magnitude. This could be a big business on its own. Vial is already generating tens of millions of dollars in annual revenue operating as a tech-enabled clinical research organization (CRO). Instead, this is Act I.

For the first time, Vial is providing a glimpse into Act II: Battery Bio. Building on its substantial cost advantage in trial execution, Vial is venturing into the world of full-stack drug discovery. They are now building an AI-first platform to advance their own medicines into the clinic.

Understanding this story requires proper context. Here, we’re going to explore the broader evolution of clinical trials before launching into the details of Vial and Battery Bio.

Here’s where we’re going to go:

Why are trials so expensive?

Act I: Structure, Digitize, Automate

Act II: Battery Bio

Let’s jump in! 🧬

Why are trials so expensive?

Understanding complex human systems requires mapping out incentives. Behavior can be incredibly confusing without understanding why people are motivated to do what they do. What are the incentives of drug makers?

Any large organization making drugs aims to maximize value capture and minimize development costs.

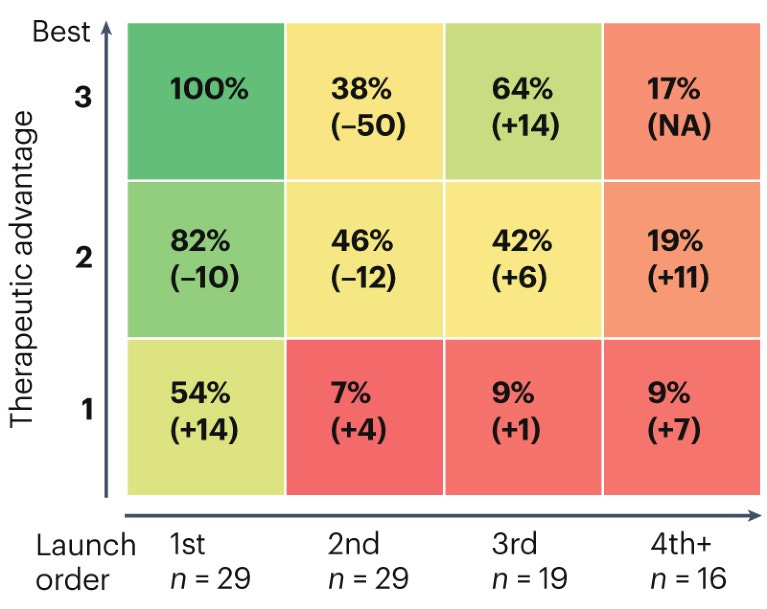

In the pharmaceutical landscape, many of the incumbent institutions have been running this optimization process for over a century. On this time scale, a simple recipe has emerged. Pharmaceutical companies have evolved to primarily focus on acquiring new medicines and using their existing sales and distribution platforms to market them. Now, two out of three Phase I trial submissions come from “emerging biopharma” companies with less than $200M in R&D expenditures and annual sales of less than $500M.

Simply put, Big Pharma is increasingly outsourcing R&D. This is great for shareholders, who profit from distributing new medicines with lower development overhead.

This is also true for clinical trials.

IQVIA, the organization that produced the preceding figure, is an instructive example. The company was born from a merger between Quintiles and IMS Health in 2016. Quintiles was founded in 1982 to provide outsourcing services to the pharmaceutical industry, primarily focusing on running clinical trials. IMS Health focused on information services to support drug commercialization. The integration of these services in the form of IQVIA now commands a market capitalization of $40B.

IQVIA is not the only business that has profited handsomely from trial outsourcing. Founded in the same year as Quintiles, Paraxel has emerged as the second-largest provider of clinical trial outsourcing services. Through a series of 40 acquisitions, Paraxel has grown into a global organization generating $2B in annual revenue.

There are roughly a dozen clinical trial CROs—all founded around the same time—that have come to dominate the market. In each story, the consolidation of smaller CROs plays a central role. Let’s think back to incentives. We’ve established that drug companies want to maximize value capture and minimize costs and have pursued this through progressive outsourcing. What is the incentive of a trial provider? Realistically, it’s to capture as much value as possible from carrying out trials. With fairly minimal competition, trial costs have skyrocketed.1

Many technologists’ reaction to Eroom’s Law is to blame the FDA and claim we’ve been impeded by overly bureaucratic regulation. Empirically, this doesn’t seem to be the case.2 The FDA has rolled out a new accelerated approval program and released several guidances for digitizing trial data capture and remote data acquisition to modernize trials and reduce costs. Adoption has progressed at a snail’s pace—these seemingly simple guidances are still far from the norm. Most trial data is still collected in person, and on paper, at enormous cost.

As Matthew Herper pointed out in his recent piece on this topic, we’ve largely dealt with this problem by finding ways to run smaller trials:

Instead of dealing with the difficulty of collecting data on new medicines, both society and government sidestepped it by focusing on treatments for much rarer illnesses: relatively rare cancers, rheumatoid arthritis, and multiple sclerosis to name a few, not to mention very rare illnesses such as cystic fibrosis or paroxysmal nocturnal hemoglobinuria.

Again, this is purely a byproduct of incentives: “This focus allowed companies to conduct smaller trials and then charge much higher prices.” Taken together with the extraordinary pace of biomedical research, we’re now developing miraculous cures for a smaller and smaller segment of the human population.

If we genuinely want to “cure, prevent or manage all diseases by the end of the century,” this needs to change. Clearly, curing rare diseases is important work. In the aggregate, rare diseases are common and cause real human suffering. Still, many ambitious young scientists decided to pursue science with the goal of ending widespread diseases like cancer, Alzheimer’s, and even aging itself.

If we’re going to fix our clinical trial infrastructure, we’re going to need technology, in Peter Thiel’s use of the word.

We need new and better ways of doing things.

Act I: Structure, Digitize, and Automate

As recently as the COVID pandemic, Simon Burns knew very little about how the medical system actually works.

While Simon couldn’t explain the difference between Medicare and Medicaid to one of his colleagues, he had years of experience honing a particular skill: mapping out bureaucratic and clunky systems and working obsessively to simplify them. Working as a product manager at Opendoor, Simon learned how to operate within a fast-moving startup that aimed to slash every frustrating and cumbersome step out of the process of buying or selling a home.

After working at Opendoor, Simon took his skills into the financial technology (fintech) sector. He worked at Chime, where he applied his maniacal focus on simplification to the mobile banking experience. Over time, he became disenchanted with fintech—the chance of making a real impact felt small. He started to search for new problems.

To start, he revisited his colleague’s question about the different types of government health insurance that had evaded him. How does American healthcare actually work? Going down this first rabbit hole, Simon began to map out the complex dynamics between insurance payers, healthcare providers, and patients.

One lesson seemed clear from his research: developing new technologies to streamline healthcare without payer buy-in would be an uphill battle. Healthcare providers lacked the leverage to adopt new technology if it wasn’t clear it would be reimbursed.3 Feeling that he wasn’t uniquely positioned to start a new health insurance company, Simon looked for other opportunities with better incentive structures in the healthcare ecosystem.

After more digging, he realized clinical trials might fit the bill.

Here’s the kernel of the idea: the incentives of drug makers are relatively straightforward. If you presented them with a faster, cheaper, and more accurate trial process, why wouldn’t they use it? Trials seemed like a more tractable market.

With the problem in mind, Simon still had no idea what the solution might look like. Here, he and his co-founder Andrew Brackin, a tenacious Thiel Fellow originally from the United Kingdom, needed answers. Together, they went on a widespread hunt for new information.

To start, they fired off hundreds of cold emails to clinical investigators. They wanted to learn how clinical trials worked in practice—as quickly as possible. The first responses came from Florida and Alabama, so they immediately got on a plane and flew across the country.

In each clinic, Simon worked to apply the product manager playbook he’d spent a decade refining: start by doing as many customer interviews as possible to map out the structure of a process. Every single day, they’d try to do three to four interviews and then convene to create a new thesis about what the most pressing problems were.

It’s the Kanye West entrepreneurial ethos:

You can't fathom my love, dude Lock yourself in a room Doing five beats a day for three summers That's A Different World like Cree Summer's I deserve to do these numbers

All of their theses were compiled into a giant Google Doc, where they were refined and iterated upon. They were moving from a broad problem definition to a concrete set of potential solutions. Knowing that they wouldn’t have all the answers or intuition themselves, they fired off their initial ideas to a list of people including Jeff Silverstein and Nikhil Krishnan, hoping for valuable feedback.

The first set of ideas got ripped apart. Completely undeterred, they used every piece of feedback to update their theses and make them more robust. While most of what they threw out didn’t stick, they honed in on the pain points that seemed most acute.

At each site they visited, they were blown away by the poor quality of the tooling for patient data capture. Trial administrators often captured measurements and information manually on paper. Next, they would battle a multitude of disparate software systems—each requiring different logins—to upload it. This didn’t make any sense.

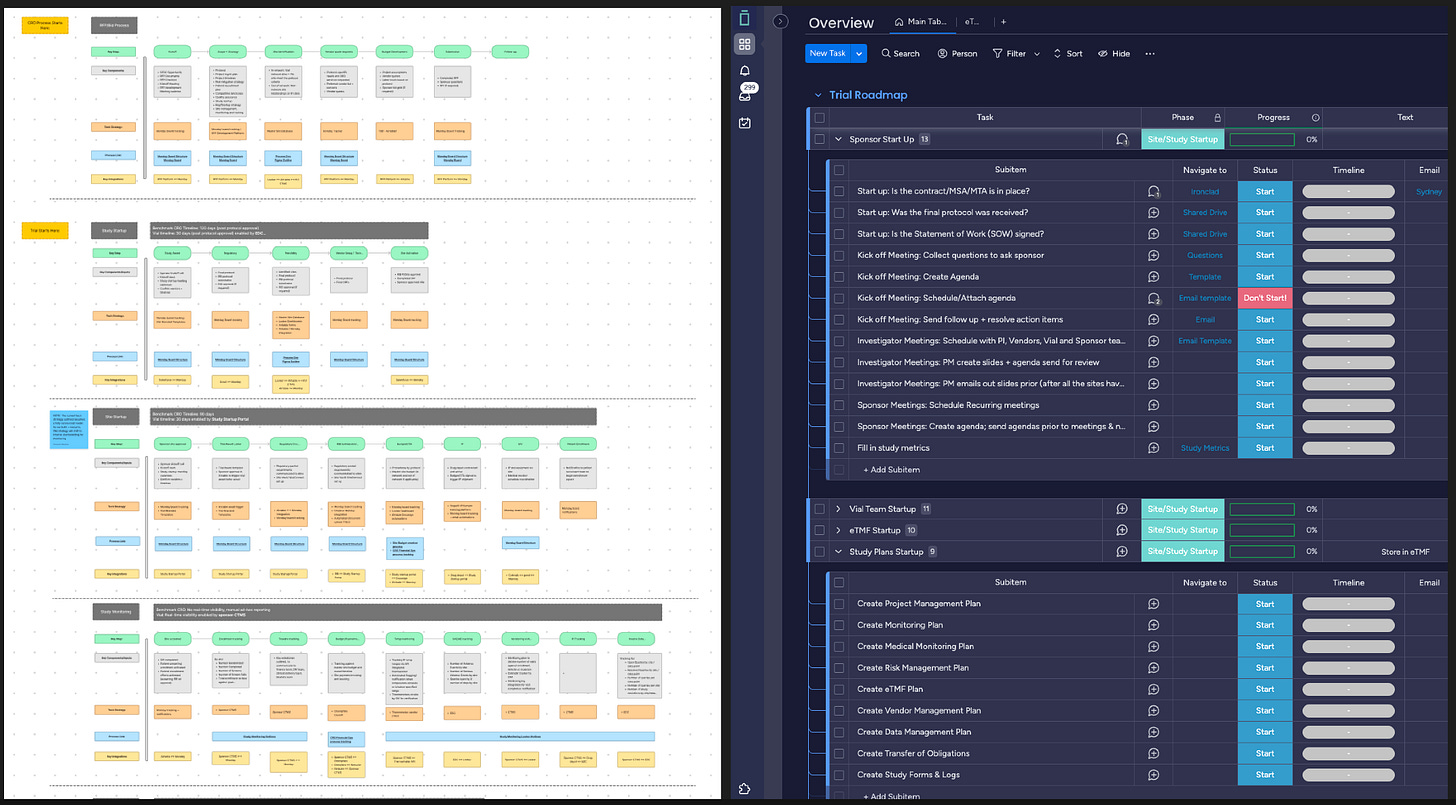

Moving further upstream in the process, they learned about all the bureaucratic hurdles trial sponsors dealt with when launching trials. Just getting started typically involves up to fifty complex and bespoke PDF documents. Gradually, they worked to map out the entire clinical trial workflow:

This was the map of the territory. As technologists, they immediately felt more comfortable at this point. They broke this workflow down into over 200 concrete tasks and sub-tasks. Just like building a software product for any other domain, they created features to digitize each task, automating as much of the work as possible.

Structure, digitize, automate.

Wash, rinse, repeat. At a high level, nothing about this work is glamorous. It’s the hard, unsexy work of digitizing a complex industry to make it run more smoothly. This logic isn’t new, but many of us overlook these types of problems. Paul Graham calls this schlep blindness: “Your unconscious won't even let you see ideas that involve painful schleps.”

One of Simon’s superpowers as a founder is that he relishes these types of schleps. Mapping out complex systems and automating them is exactly how he wants to spend his time. There’s a deep pleasure in it for him. The key is to find a schlep worth undertaking.4

The result of all of this work is TrialOS, a software platform with three central pillars dedicated to site startup, digital visit capture, and study analytics.

The goal is to drive evolution, not revolution. Vial isn’t trying to change the central framework of trials—randomized experimentation has been the gold standard since the 1940s for good reason. The platform is agnostic to whether trials should be centralized or decentralized—it all depends on the therapy being tested. They aren’t trying to revolutionize patient recruitment—leading physicians can often do this better than software marketplaces.5 They are trying to relentlessly optimize the fundamentals.

Structure, digitize, automate.

Seemingly small details can compound. The North Star for Vial is to drive a 10x improvement in both the speed and cost of clinical trials. This can sound hyperbolic, but it is likely not impossible, given the massive inflation of trial costs over the last fifty years.

This isn’t hypothetical. Vial is actively running 12 clinical trials, two of which are Phase III. Currently, Vial is operating sites in the U.S. and Latin America. Studies have ranged from real-world evidence collection for eye disease to more involved trials for tropical diseases in partnership with the nonprofit Medicines Development for Global Health.

They hope that this is only the beginning of their CRO business. Last quarter, they received 41 new request for proposal (RFP) submissions from trial sponsors. They aim to win as many of these trials as possible by competing on cost, speed, and quality. The long-term vision is to cement themselves as a trusted trial provider by improving every component of the sponsor experience.

So, what would the world look like if Vial succeeds?

Let’s think back to incentives. Over time, we’ve seen how the bulk of early-phase development is now carried out by smaller companies with less than $200M in R&D expenditures and annual sales of less than $500M. Even if these companies aim to build novel discovery platforms that produce multiple new products, they must ruthlessly prioritize one or two medicines to advance into trials.

Vial wants to change this equation.

In the bull case for Vial, the development of TrialOS would enable companies to pursue up to ten times as many drug candidates in parallel. This would open the aperture for drug development, giving emerging companies more breathing room in pursuit of their first clinical success.

Vial has now had a front-row seat to dozens of trials. They’ve seen the product features that trial sponsors have adopted and shied away from. Their electronic tablets and eSource solutions have been welcomed with open arms. On the other hand, their remote data capture solutions—which could make the difference between a 2-3x cost reduction and a 10x cost reduction—have been less widely adopted so far.

What if they could aggressively dogfood the most cutting-edge features of their platform? This could further accelerate reductions in trial speed and costs and open the door to massive value capture. Taking inspiration from the entrepreneurs that came before him, Simon has always been fascinated by companies with multiple acts. He studied how businesses such as Square achieved a market wedge with their widely used digital point-of-sale solutions for small businesses before introducing additional financial products such as Square Cash (now Cash App).

Now, Vial is unveiling their own second act.

Act II: Battery Bio

It could be argued that one of Vial’s most significant advantages so far has been their lack of experience. Outsiders can bring fresh perspectives to existing business sectors. Vial is a CRO co-founded by a tech product manager and a Thiel Fellow, and they operate like it. Rapid iteration is a central part of company culture. The company has attempted to analyze the entire clinical trial process from first principles, mapping each step to a feature in their software product. Now, they want to develop their own medicines to take full advantage of the trial infrastructure they’ve built.

What does this philosophy produce when applied to drug discovery?

We can answer this by analyzing Battery Bio, Vial's internal drug discovery arm. One of the central themes of this newsletter is that software is increasingly playing a central role in biotech. For Battery Bio, this thesis is front and center. Starting from a blank slate, software is infused into every step of the discovery process.

Any discovery process starts with identifying which biological targets to drug. Cognizant that their strength does not lie in producing new biological insights, Vial is beginning with a focus on clinically validated targets. This logic isn’t new—it’s called the “fast follower” strategy, and it is a common clinical development strategy among biotech companies.

Even with this focus, nearly a thousand targets could still be pursued. Here, a blend of software and human expertise is used to make the fastest possible decisions for prioritization. Metrics for target competitiveness (such as the number of approvals and trials) and biological feasibility (including computational scores of druggability and complexity) are integrated with feedback from their scientific advisory board. This reduces the search space by roughly an order of magnitude to ~100 potential targets.

Once you have a set of targets, how do you identify new molecules to bind to them? Again, with software. This logic isn’t new, either. Schrödinger Inc., one of the market leaders for computational drug discovery, was founded in 1990. When Roivant Sciences expanded their focus from purely in-licensing existing clinical assets, they also built out their own in silico discovery engine.6

Starting from a blank slate, they can build on the state-of-the-art techniques in generative chemistry. After rapid iteration between design, synthesis, and testing, Vial has produced a set of candidate molecules for further development.

What’s the fastest possible way to generate preclinical data for each candidate?

The consensus approach is to run preclinical tests in animals. Experiments typically start in mice before moving to slower, more costly studies in non-human primates. Cost and speed aren’t the only drawbacks of this approach. The biomedical community has achieved extraordinary preclinical results in mice—including full-fledged cures for cancer—that have failed to translate into human cures. While it’s never been a better time to be a mouse, this has raised serious questions about our current preclinical disease models.

Vial wants to pursue alternatives. New organoid and organ-on-a-chip (OOC) technologies are the primary candidates of interest. Organoids and OOCs integrate techniques from bioengineering, microfluidics, and materials sciences to simulate human physiology in a dish. This type of technology can potentially make preclinical work faster, cheaper, and more predictive of actual outcomes.

This field has produced impressive results for over a decade, but broader adoption has been slow. Again, Vial isn’t attempting to reinvent the wheel at every single stage of discovery—they are trying to integrate all of the best and fastest technologies together. They are partnering with leading providers of these technologies to create a starting preclinical data package without animal studies.7

This type of decision-making is baked into the company’s DNA. The “base case” is to submit a trial application without any animal data. If that needs to change, they’ll iterate.

With preclinical data collected, a drug still needs to be manufactured at a sufficient scale to run first-in-human trials. This work is typically contracted out to Contract Development and Manufacturing Organizations (CDMOs). While the build-vs-buy analysis for preclinical model systems skewed heavily in favor of buying, this was not the case for CDMOs.

The team at Vial was shocked by the quoted prices and time scales from CDMOs. Instead of settling, Vial hired experts and set out to build their own automated labs for chemical synthesis. They felt they had identified another market inefficiency. Given the substantial time and cost of every other step in the drug discovery process, manufacturing was an afterthought. As a result, commercial offerings lagged behind what should be technically possible.

Battery Bio is a story of vertical integration.

Taken individually, no part of their stack is groundbreaking. There is fierce competition to innovate within in silico drug discovery. Organoids are not new technology. Faster chemical synthesis won’t spark a revolution on its own. The fundamental insight is that integrating each part together will give Vial a chance to exploit their true advantage: faster and cheaper trial execution.

Tesla has had remarkable consistency in scaling the number of new Teslas delivered to customers each quarter. This results from a unique meta-level obsession for Elon Musk: The Factory is the Product. You can’t distribute new electric cars around the world without a laser-sharp focus on streamlining manufacturing.

This mantra is central at Battery Bio. There are a lot of known drug targets, so the starting goal isn’t to focus on finding more. Instead, the goal is to vertically integrate all of the different advances in drug discovery into an engine built explicitly for scale. What if we could test dozens, or even hundreds, of new medicines in parallel with speed and efficiency?

Even the early numbers indicate the difference in scale that Battery Bio is aiming to capitalize on. There are currently 21 programs hurdling toward a trial launch. While this is already an order of magnitude more programs than essentially any other early-stage biotech, it’s only the start.

Over the next few years, Battery Bio is aiming to launch over 1,000 programs on the Vial platform. For reference, Merck currently has ~120 clinical-stage programs. If Vial succeeds in achieving this scale, they could be operating the largest number of clinical trials in the entire biopharma industry.

In a lecture in 2017 at Stanford, Peter Thiel argued that there have only been two types of technology businesses that have captured substantial value over the last 250 years:

Vertically integrated complex monopolies. These are businesses such as Ford and Standard Oil that required deep integration across a wide range of processes. Innovation happened at the systems level. Modern equivalents can be found in Tesla and SpaceX, but these types of businesses are harder to build and less common.

Software. The world of bits has several properties that favor value capture. Software benefits from incredible economies of scale, low marginal costs, and viral adoption rates for successful products.

What’s fascinating about Vial is that it blends these two strategies. The starting wedge is a software product for vastly more efficient clinical trials. Disease-specific CROs are built around this central layer to accelerate adoption. A tech-enabled suite of CROs has the potential to be a big business in its own right, but it’s only Act I.

Act II layers on the Battery Bio drug discovery engine, which integrates a range of advances in computation and automation into a single system. In a way, this attacks the main weakness of the unbundling of pharmaceutical development over the years. As Big Pharma companies have progressively outsourced everything from drug discovery to clinical trial administration, massive inefficiencies have crept into the pipeline. Vial’s mission is to root out each inefficiency and create a modern, vertically integrated drug discovery factory.

This is an extremely ambitious vision. Whether or not the medicines flowing out of Battery Bio succeed in the clinic, Vial is introducing intense competitive pressure into markets that haven’t been stress tested in decades. To truly manifest The Century of Biology, we need to reimagine our infrastructure for delivering breakthroughs to patients.

If we are serious about attempting to cure all human disease, we need more moonshots like this.

Thanks for reading this essay about Vial. If you don’t want to miss upcoming essays, you should consider subscribing for free to have them delivered to your inbox:

Until next time! 🧬

As an exercise for the interested reader, check out the average annual growth rates of clinical trial costs from the 1980s into the 2010s.

Specifically, I’m talking about the time and cost of running conventional clinical trials with standard products such as small molecules. Innovation outside this, such as new trials for precision medicine approaches, may be a different story.

This tension can be particularly challenging when it comes to improving Electronic Health Record (EHR) software. From a recent review on this topic, “Misalignments between health plan executives and physicians at the point of care delivery for the included plan recipients. This includes electronic health record (EHR) functionality, optimizing EHR reporting, and patient identification. In one survey, this misalignment was apparent: 75% of healthcare executives stated that current EHRs had everything needed for physicians to deliver value-based care and measure patient outcomes. In contrast, only 54% of physicians agreed in response to the same question.”

One of Ryan Petersen’s key insights when building Flexport—a company streamlining logistics—was to look for an industry with the highest GDP to software-utilization ratio. Incumbent industries like logistics and clinical research that produce enormous value but lack modern tools are an ideal place to embrace the schlep.

While their focus isn’t on a marketplace offering, they aim to accelerate recruitment through marketing and EMR search for potential participants.

In China, don’t expect to see any credit cards. Why? They transitioned directly from cash payments to digital payments, entirely skipping a generation of payment technology. If you’re building a small molecule discovery engine in 2023, computation will play a central role.

A few factors indicate that Vial is riding tailwinds that could soon lead to broader adoption of these technologies. To start, there have been substantial shortages of non-human primates after allegations of smuggling from major providers dramatically reduced their supply. Simultaneously, OOC providers have begun to outperform conventional models for predicting toxicity. From a regulatory perspective, the FDA Modernization Act 2.0 moved to make animal testing optional. Now, Big Pharma companies are investing heavily in this space.

Elliot, great timing on this post. Really enjoyed learning about Vial. This high throughput model for drug discovery/development/and testing is awesome. Going full stack is truly the only way to turn the dogmatic nature of this industry on its head. I could almost see Vial becoming the infrastructure layer for "fabless" pharma and techbio companies. First vertically integrate like amazon and then start offering AWS etc.

Have you heard of Novartis's data42 initiative? I would love for your to explore some ways that big pharma companies are attempting to become more tech native. Looking forward to more posts as always!

Hey Elliot! As we delve into the exciting frontier of biology, your insightful article on Vial's vision truly sparks my interest. With innovative minds like yours and the advancements in AI-first platforms, I'm optimistic about the transformative potential of clinical trials. Looking forward to more fascinating reads from you!