Illumina: The Measurement Monopoly

How one biotech company changed the arc of genomics

Welcome to The Century of Biology! This newsletter explores data, companies, and ideas from the frontier of biology. You can subscribe for free to have the next post delivered to your inbox:

Enjoy! 🧬

No technology has ever improved more rapidly than DNA sequencing. The resulting explosion of genomic data has played a central role in transforming biology into an information science. We now browse genomes, search vast databases of biological annotations, and explore digital atlases of cells.

Sequencing individual genes used to take years—now, complete human genomes take hours. Our ambitions have scaled linearly with each step change in sequencing capacity. After completing the Human Genome Project in 2003, projects are underway to sequence the genome of every known species on Earth and produce a genetic atlas of every cell type in the human body.1

How did this happen?

How did we develop the scientific capacity that let us even contemplate sequencing the genetic code of every living organism on our planet? The story of progress in genomics is one of fierce competition. The race to complete the first human genome has been referred to as The Genome War—it was an epic contest between the public and private sectors. This competitive spirit spilled over into the commercial DNA sequencing market, leading to the genomics cost curve that I continually refer to.

An incredibly unlikely winner emerged from this battle. A small startup in San Diego founded by a blind venture capitalist, a veterinarian with an MBA, a Harvard professor, a chemist, and a molecular biologist produced a genomics instrument that would become synonymous with DNA sequencing. Ironically, this company played no role in The Genome War—the first ideas for its technology had nothing to do with genomics.

I’m describing the birth of Illumina, a company that established a Measurement Monopoly in the life sciences. I mean this in the Thielian sense. Illumina invented a profound new measurement technology and paired their innovation with a business strategy that enabled them to capture enduring differential returns over time.

Admittedly, it’s a strange time to be writing about Illumina. The company is in the middle of its own war with the famous activist investor Carl Icahn—largely prompted by a protracted regulatory blocking of a major merger. As critical patents approach their expiration, Illumina is facing real competition from many new entrants into the DNA sequencing market.

I’m not going to talk about that, and I’m certainly not here to offer investment advice about a publicly traded company. Instead, we’ll examine this business's origin and trace its path to Power. Illumina defined a new category of biotech, and there is much to be learned from studying how it did so. Through this analysis, we’ll arrive at a deeper understanding of one of the most important technologies of the 21st century—we’ll also see what it looks like to capture some of the value produced by such an invention.

A nose for important chemistry

Although he inherited a retinal disease that left him legally blind by age 29, Larry Bock was born with an innate sense for chemistry—not only between molecules but also between people. After failing to achieve his childhood dream of becoming a physician, Bock landed at a little-known startup in the San Francisco Bay Area called Genentech.

This turned out to be an incredibly fruitful branching point. At Genentech, he had a front-row seat to the birth of the biotech industry, where his chemical intuition could be uniquely leveraged. Building on this experience, Bock started several successful companies, bouncing between chemistry, biotech, and nanotech.

As his successes started to compound, Bock developed a unique way of working. He acted as catalyst for new ventures, traveling all across the country to pair the most promising new scientific ideas and their inventors with ambitious entrepreneurs. Bock was unwilling to compromise on the quality and ambition levels of the founders he supported.

Tony Czarnik described Bock’s distinct style of investing, saying, “He learned about starting companies from his father, and with his degree in Chemistry decided, ‘this can't be so hard.’ He believed in putting the best people together to start companies and allowing them to decide where the company would be based. His recipe proved wildly successful for several decades.”

One of these companies was Illumina. A founder in Bock’s network name Clark Still told him about a new technology created in the laboratory of David Walt while he was at Tufts University. Simultaneously, the licensing office reached out to Bock to see if he had interest in helping to commercialize the technology. Walt was developing approaches to create bead-based fiber-optic arrays. To start, optical imaging fiber—the same material that undergirds the Internet—is etched to form miniature wells. These wells are then filled with chemical microspheres.

The reactions taking place in each bead excite the optical fiber, producing a signal that can be detected by image analysis software. In this way, a massive number of chemical reactions can be measured in parallel, providing the foundation for scalable detection of multiple analytes at once.

It’s worth briefly reflecting on this. Many people know that I’m a fan of the term TechBio. A lot of people aren’t. They view it as a superficial term coined by VCs. Why do I like it? We’re currently talking about a technology that embeds chemical beads directly onto a fiber-optic surface, making measurements only detectable by software. This represents a deep convergence between technology and biology. What other term would you use to describe this?

Returning to our story, Bock was thrilled about this technology. He had a distinct appreciation for scalable chemistries and felt that “beads had been very good to him” in his career. A company was incorporated in April 1998 with Walt as the scientific founder. The primary question at this point was what the most valuable application for this technology would be.

Previously, Walt had worked on creating “artificial noses” that could detect complex odors. This seemed like a reasonable commercial opportunity for the array technology. John Stuelpnagel, an associate at Bock’s venture firm, felt differently.

Stuelpnagel had trained as a large animal veterinarian before realizing he was much more interested in business. He pivoted and enrolled in the MBA program at UCLA. When the opportunity arose to join Bock’s firm, he hustled to balance a full-time investing position while finishing the remaining classes in his program. Stuelpnagel was intrigued by Walt’s work on creating DNA microarrays using his fiber-optic technology.

DNA microarrays were already starting to transform biology. At the time, these devices were primarily used to measure the expression levels of thousands of genes in parallel. They can also be used to detect DNA variants—called single nucleotide polymorphisms (SNPs)—which made it possible to measure the genotypes of large numbers of individuals. Stuelpnagel realized that Walt’s technology—specifically the high-throughput random placement of beads on the fiber—made it possible to make these “SNP chips” much more scalably than any of the competing approaches, and that genotyping was a much less crowded market than gene expression measurement.

Bock wasn’t convinced. He felt that Affymetrix—the leading DNA microarray provider at the time—had covered the patent landscape too exhaustively for a new competitor to enter the market. The lawyers supporting the new company felt similarly. Undeterred, Stuelpnagel pressed forward.

He recruited Mark Chee, a Cambridge-trained molecular biologist who had worked as the Director of Genetics at Affymetrix, and was incubating a new venture called nGenetics that had developed crucial IP for decoding the type of randomly assorted arrays that Walt’s chemistry created. After some discussion, Chee agreed to roll his company together and join Illumina as a co-founder. As we’ll see, this would be the first of a long string of highly consequential acquisitions.

Illumina would be a genetics company.

The last co-founder to join the team was Tony Czarnik, who was a chemistry professor at The Ohio State University before transitioning into leadership positions in the chemical industry. Tony joined as the CSO. Illumina was reincorporated in Delaware in June 1998, and CW Ventures—Larry Bock’s fund—joined forces with Bob Nelsen at ARCH Venture Partners to finance the company with roughly $1.5M to get going.

As a new technology company with no working product, Illumina continued to turn to venture capitalists to finance their efforts. The company found a receptive audience at Venrock, where a brand-new investor named Bryan Roberts had just joined after finishing his PhD in Chemistry & Chemical Biology at Harvard. With the context to understand the technology, Illumina’s Series B round would become Roberts’s first-ever venture investment. After this round, the pace of activity accelerated.

The following two years were a flurry of activity. Illumina raised another round of financing and acquired Spyder Instruments for their high-throughput DNA synthesis capabilities. Illumina’s internal R&D lab began to swell with scientists. The company grew to 60 employees—more than two-thirds of the early employees were engaged in research.

After one more round of private financing, Illumina prepared to go public. As a first-time CEO, John Stuelpnagel started to question whether he was the ideal leader for the company's next stage. In a uniquely selfless decision, he recruited his own replacement and communicated this decision to the board of directors. Jay Flatley, who had previously served as the CEO of Molecular Dynamics, was recruited to join as the new CEO of Illumina. This turned out to be a great pick—Jay would lead Illumina for the next 17 years, navigating the company through many complex decisions.

At this stage, Illumina was still just a research company with no products on the market and a deficit of $10.6M. Still, the successful IPOs of Apple and Genentech several decades earlier and the genomics craze of the late 90s had shifted the sentiment around the stage at which a technology company should publicly offer shares. A section in the Risk Factors portion of their S-1 filing read,

We Have Generated No Revenue from Product Sales to Date. We Expect to Continue to Incur Net Losses and We May Not Achieve or Maintain Profitability.

What Illumina did possess was an acute vision for an emerging genomics market.

They wrote,

We believe that advances in genomics will underpin the future of medicine. To date, billions of dollars have been spent on the sequencing of the human genome. We anticipate that during the next decade, a substantially greater amount will be spent on efforts to understand the function of the genome and to apply this information to medicine and related industries. A significant portion of these funds will likely be used to purchase tools for the analysis of genetic variation and function.

In July of 2000, three years before the completion of the Human Genome Project, Illumina entered the public market. Investors had an appetite for their vision of a genomic future. The company raised $96M, selling shares for $16. Just two years after incorporation, Illumina was a publicly listed company with a market capitalization of $500M.

Illumina started offering genotyping services in 2001 and launched their first product offering—the Illumina BeadLab—in 2002. It turned out that their initial thesis was correct. There was a massive appetite for genotyping technology.2

Scientists around the world started using DNA microarrays to hunt for genetic variants associated with disease. In 2005, researchers at Duke conducted the first genome-wide association study (GWAS), measuring SNP frequencies across the genome in patients with age-related macular degeneration.

The logic of a GWA study is simple. Genotypes for every common genetic variant are collected for people with and without a phenotype—typically a disease—a classic case-control study design. Next, the statistical correlation between each variant and the phenotype is computed. The result is a set of SNPs that are frequently present in that phenotype. The interpretation is that these genetic variants must play a role in the underlying biological processes that drive the phenotype.

By the late 2000s, thousands of disease-associated SNPs had been uncovered. The so-called “GWAS era” was in full effect, and Illumina was a leading DNA microarray provider. Still, there was a problem. As study sizes grew, the results only got more confusing. Diseases often had many associated variants, of which roughly 90% fell outside of regions in the genome that encode genes. These findings crushed the notion that geneticists would be able to sift out “the gene for Alzheimer’s disease” through simple statistical studies. The human genome turned out to be far more complicated than we had ever bargained for.

As Jay Flatley recalled in an interview, “A key part of what Illumina did is provide the technology in the 2002 to 2007 timeframe that invalidated the common variant/common disease hypothesis. It was a surprise to many that we weren’t able to unravel biology by doing deep genotyping that was all the rage during the GWAS era.”

It was becoming clear that genotyping alone wouldn’t be the future of genomics. Around this time, the race to develop Next-Generation Sequencing (NGS) technology was heating up. For Illumina to remain a dominant genetics company, they would need to adapt quickly.

Solexa, Inc.

By the end of the Human Genome Project in 2003, a clear commercial leader for DNA sequencing had emerged: Applied Biosystems. Founded in 1981 to commercialize automated genetic analysis technology developed at Caltech by Lee Hood—one of the earliest pioneers of genomics—Applied Biosystems provided a substantial portion of the instrumentation for the Human Genome Project. They also equipped the new biotech companies such as Millenium Pharmaceuticals that were using the same tools to produce new medicines.

In fact, Applied Biosystems gave birth to Celera Genomics, the private competitor to the government-funded Human Genome Project. After being acquired by a firm called Perkin-Elmer, the company's new president realized they might be able to win a race against the government project. By establishing an industrial-scale center full of their latest machines, they could potentially leapfrog existing efforts and capture rights to a genetic dataset with immense commercial value.3

Ultimately, Applied Biosystems provided the picks and shovels to both sides of The Genome War.

Despite this seemingly insurmountable starting position, serious contenders emerged to challenge Applied Biosystems for primacy in the DNA sequencing market. Moving beyond the challenge of simply completing the human genome, these companies competed to drive down costs from the $300M price tag at the end of the Human Genome Project to as low as $1,000. Three of the main challengers were Pacific Biosciences, 454 Life Sciences, and Solexa Inc.

Operating in stealth out of an industrial park in Silicon Valley, Pacific Biosciences worked to invent entirely new sequencing technologies to drive down costs. It started as a moonshot research company with deep backing from premier Silicon Valley investors, including Kleiner Perkins. Their CEO was quoted saying, “If we ever make this work, there would be no other technology applicable in the sequencing field.” The problem was that they weren’t shipping instruments. Delays continued to creep into their release timelines.

Founded on the East Coast, 454 Life Sciences brought a completely different level of urgency to their technology development. In the late 1990s, a scientist-entrepreneur named Jonathan Rothberg had emerged as a sort of genomics wunderkind. As a graduate student at Yale, he founded a genomics called CuraGen that quickly became a stock market success—by the year 2000, it was a public company with a market capitalization larger than American Airlines.4

Despite this initial success, when Rothberg’s second child ended up in the neonatal intensive care unit after birth, genomics still had no practical utility in the clinic—it was still impossible to rapidly search for inherited diseases. This prompted Rothberg to spin 454 Life Sciences out of CuraGen and enter the race to make personalized genomics a reality. While Pacific BioSciences remained an R&D company, 454 had already released the first commercial next-generation sequencing instrument by 2005—winning the Wall Street Journal's Gold Medal for Innovation in the Biotech-Medical category.5

In 2008, 454 achieved a significant milestone for genomics, sequencing the first genome of a single individual at the price of $1.5M in only four months. The individual was Jim Watson. Having co-discovered the double helical structure of DNA, Watson became the first person with a complete record of his own genome.

As the race for the $1,000 genome heated up on both American coasts, a stealthy British startup called Solexa Inc. continued to refine their own chemistry for next-generation sequencing. The company can trace its roots back to August 1997, when a group of Cambridge scientists spent the evening in the Panton Arms pub, spitballing ideas about nucleic acid chemistry.6

In attendance were two collaborators, Shankar Balasubramanian and David Klenerman. Balasubramanian had studied the molecular biology of nucleic acids, while Klenerman specialized in biophysical chemistry. Together, they had an elegant idea for a totally new approach to DNA sequencing:

Those ideas centered on tracking the movement of DNA polymerase, by visualizing single molecules as they incorporated nucleotides step-by-step on a solid surface. One day, perhaps, they could draw inspiration from microarray companies like Affymetrix and parallelize the process. “We were just playing around, to be honest,” said Balasubramanian.

In 1998—the same year as Illumina’s launch—British venture capitalists helped launch Solexa based on these ideas. From the beginning, the vision was clear. Balasubramanian felt that the technology could drive a 100,000-fold improvement in the cost of DNA sequencing.

This technology is now called Sequencing-By-Synthesis (SBS), and it’s quite beautiful. To start, the DNA being sequenced is chopped up and immobilized on a solid surface. Next, specially labeled nucleotides are added. These nucleotides are designed to terminate elongation when incorporated into a growing strand of DNA. At each step of incorporation, the base being added can be detected by its fluorescent label via imaging.

Fearful of being decimated by the monolithic Applied Biosystems, Solexa quietly improved this technology over time.7 While other companies and labs published breakthroughs in DNA sequencing, Solexa preferred to protect their chemistry with patents and avoid journals altogether. After years of stealthy R&D, the company became publicly traded via a reverse merger in 2005.

By this point, Illumina had gained serious steam. They had already acquired two companies as they grew their war chest from success in the DNA microarray market. Enticed by the complementary nature of Solexa’s sequencing chemistry with their existing products, Jay Flatley offered $650M to buy the company in November of 2006.

The Solexa team was thrilled. After years of work, they had attained an offer that represented one of the largest commercial successes to ever spin out of Cambridge University. The acquisition proceeded. Presciently, Jay was quoted saying, “This acquisition... may prove to be one of the most successful acquisitions and new technology introductions in the history of the life science industry.”

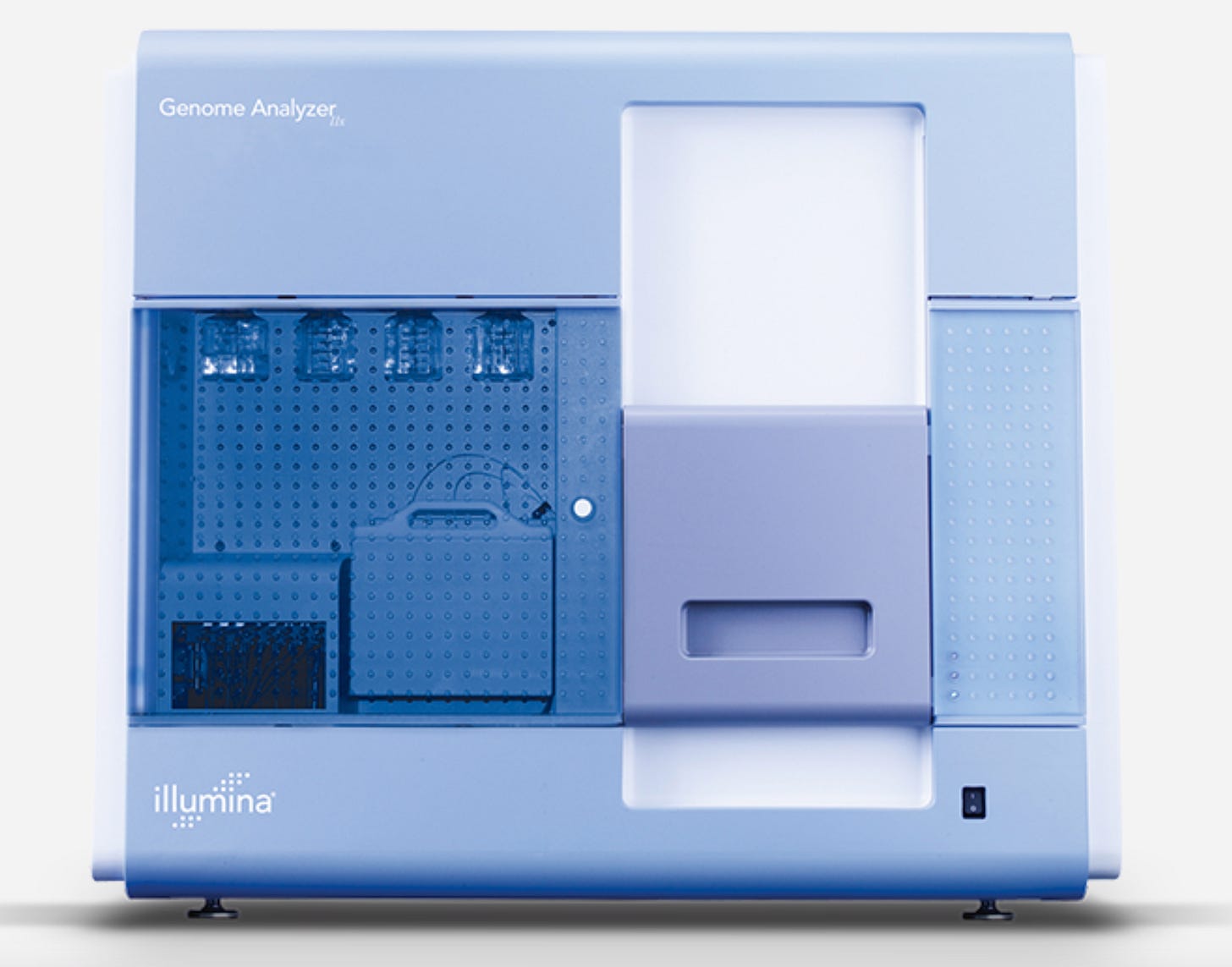

He was right. In one acquisition, Illumina was suddenly at the center of the race for the $1,000 genome. Illumina began offering the Genome Analyzer—a commercial SBS instrument—in 2007. They sold over a dozen instruments in the first year, with many more orders in the queue.

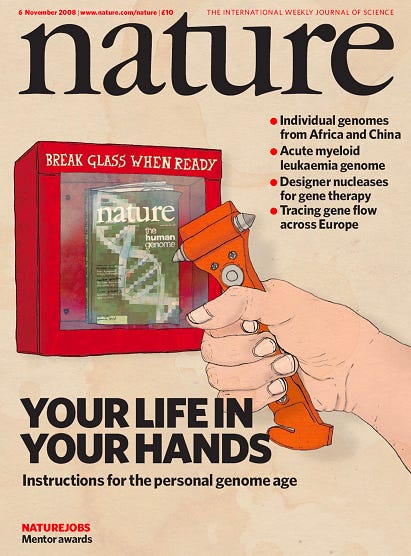

The Genome Analyzer made an immediate scientific impact. In 2008, researchers at the Beijing Genomics Institute reported the first diploid genome of an Asian individual in the journal Nature. In that same journal issue, Illumina produced their own report of an African genome, and a group from Washington University in St. Louis published the genome of a cancer. Illumina’s Genome Analyzer produced the data for each study.

After pondering initial applications in odor detection, Illumina became a leading DNA microarray company. Now, their state-of-the-art sequencing instruments were ushering in the personal genome age and rendering other technologies obsolete. In 2010, Illumina launched the HiSeq 2000 instrument, which was capable of sequencing a genome for $10,000. By 2013, 454 Life Sciences—at this point a subsidiary of Roche—shut down operations because its instruments were no longer competitive.

John Milton, an essential early employee at Solexa, quipped that “The Brits are the great inventors, and the Yanks are the guys who are great at putting it in a box and selling it.” Debates about primacy in invention aside, Illumina proceeded to sell a lot of boxes. By 2014, they had captured 70% of the DNA sequencing market, producing 90% of all genomics data—and had won the race to the $1,000 genome.

In order to understand this remarkable market dominance and staying power, we’ll need to do more than focus exclusively on the underlying technology. To do this, we’re going to use some of the tools from the broader field of Strategy to analyze the properties of Illumina that made it such an outlier in a competitive market.

Strategic analysis

After years of successful active equity investing and business consulting, Hamilton Helmer developed a “simple but not simplistic” framework for analyzing strategic competitiveness. In 2016, Helmer shared these insights with the world in a book called 7 Powers: The Foundations of Business Strategy. This book has become a cornerstone in the field of Strategy, which Helmer defines as “the study of the fundamental determinants of potential business value.”

What is a Power? It is “the set of conditions creating the potential for persistent differential returns.” In other words, a Power is a property of a business that gives it pricing power over time against competitors in a market. Remarkably, Illumina provides a nearly perfect case study for—in my estimation—five of the seven Powers outlined by Helmer. We’ll explore each property of Illumina to explain how it was able to achieve a Measurement Monopoly in genomics over time.

Helmer avoids overly abstracting Strategy, acknowledging that “the first cause of every Power type is invention.” Without a real breakthrough at the core of your business, no amount of Strategy will save you. In biotech, this is directly evident. Most businesses start by inventing a new technology or drug and protecting it with a patent. This was also true for Illumina. In Helmer’s terminology, this is a Cornered Resource:

Preferential access at attractive terms to a coveted asset that can independently enhance value.

An example is the patent rights to a blockbuster drug. For Illumina, this was their intellectual property (IP) portfolio that started with Walt’s bead-based array and expanded through over a dozen acquisitions—including of Solexa—to cover much of modern genomics.8

Still, other companies were rapidly developing new sequencing technologies. Even if Illumina had rights to a breakthrough chemistry, they couldn’t rest on their laurels. One major advantage was their early market timing, followed by the rapid placement of their boxes in several key genome centers. Once in place, there was a high barrier to switch to a new instrument.

Solexa’s Milton described this advantage, saying “That’s one of the few reasons Illumina dominates the SOLiD system—they got there first. Once you’re a genome center and everybody’s trained, you stick with [the technology].” Helmer calls this Power Switching Costs:

The value loss expected by a customer that would be incurred from switching to an alternate supplier for additional purchases.

As more genome centers and labs around the world standardize around a specific technology, it becomes a platform.9 Scientists began to treat Illumina’s sequencing technology as a core building block, developing a massive number of new protocols and technologies on top of it. As this happens, a lab purchasing a new instrument benefits from choosing the one that other groups are using. This is the Power of Network Economies:

A business in which the value realized by the customer increases as the installed base increases.

The greater the number of boxes Illumina sold, the more they were able to amortize the costs of R&D and manufacturing across each sale. Imagine two companies making a sequencing instrument. Both companies incur the same development costs, and need to establish expensive manufacturing operations. One company sells ten times more boxes than the other. The latter company will need to charge far more per box to recoup their costs. In this way, Illumina established a moat against new entrants in the sequencing market through scale. This is the Power of Scale Economies:

A business in which per unit cost declines as production volume increases.

Over time, Illumina’s technology became synonymous with DNA sequencing. Their success wasn’t purely a function of cost and scale—they obsessed over product excellence. Jay Flatley has continually listed Apple as a major source of inspiration. His wife, Sarah Flatley, was the VP of Finance at Pixar. This gave him a unique window into Steve Jobs’s return to Apple—which happened around the time he took the helm at Illumina.

Sustained product obsession can lead to one of the most elusive Powers, Branding:

The durable attribution of higher value to an objectively identical offering that arises from historical information about the seller.

The jury is still out on the durability of Illumina’s Branding. As some of their critical patents approach expiration, will they be able to retain pricing power against competitors given that the Wikipedia page describing sequencing-by-synthesis is entitled Illumina Dye Sequencing? What will be the long-term value of the historical trust around quality that Illumina has built with genome scientists?

Using Helmer’s 7 Powers framework, we can see that Illumina developed five distinct business properties that enabled them to capture enduring value from their scientific inventions:

Cornered Resources — valuable chemistry and hardware IP

Switching Costs — genome centers want to avoid buying new instruments

Network Economies — Illumina sequencing became a standard protocol

Scale Economies — there are many fixed costs in tool development

Branding — sustained product excellence can lead to pricing power

Over time, Illumina has used the dominant market position resulting from their Powers to derive impressive recurring revenue from the sale of reagents and consumables to their large install base. The overall gross margin for the business hovers around 60%, but this doesn’t tell the whole story. Somewhat counterintuitively, the margins for the actual sequencing instruments are slim—some back of the envelope math would even suggest they are nonexistent. The real value driver is to sell their consumables, which have closer to 80-90% margins.

Illumina’s Cornered Resources around their SBS patents coupled with compounding Scale Economies have enabled them to consistently drive down sequencing costs. This has made entry into the market extremely challenging for competitors. As I alluded to earlier, as costs have declined, genome scientists have continually pursued larger and more ambitious projects. As Jay Flatley put it,

One of the models that I’ve always adhered to is that as you drive prices down in this market in particular, you open up gigantic new applications, so it’s a market that clearly demonstrates economic elasticity. And as we get toward the $100 genome, sequencing will have the opportunity to become pervasive.

It’s truly our vision that everyone gets sequenced at birth, that it becomes part of their normal medical record, that it gets used routinely in managing their health throughout their lifetime, and that we can actually make the technology disappear into the background.

Scientists sometimes groan about the consumable costs for Illumina, and that’s understandable. As the sequencing market heats back up, there should be even greater pricing pressure. Still, it’s hard to argue with the immense value that Illumina has produced. They’ve discovered a high-volume, high-margin business model that has undoubtedly changed the trajectory of an entire field of science. That’s a powerful case study for any aspiring Scientific Capitalist.

Illumina’s legacy

Twenty five years after its founding, Illumina is still going strong. Despite the current turmoil on its board and management team, the business remains a clear leader in the genomics market. While Illumina’s story is still being written, it’s worth reflecting on the mark that it has already made on the biotech industry.

Starting out in the shadow of towering pharmaceutical giants, most biotech companies aspire to produce drugs. This makes sense for several reasons. Most funded research is biomedical in nature—the National Science Foundation’s budget is one fifth the size of the National Institutes of Health budget—the mission to cure disease keeps the lights on. Taxpayers understand the need to fund research for new medicines.

Drugs are great products. They objectively make the world better while simultaneously making their inventors wealthy. While hunting for their own blockbusters, small biotechs can partner with existing pharma companies. There is a playbook to follow.

Selling research tools is a much less obvious opportunity. It requires discipline and long-term market vision to decide against creating a vertically integrated drug discovery company around a new measurement technology. Growing to a $30B business, Illumina has proven that research tools can deliver massive venture-scale returns. They’ve shown that a horizontal axis exists in the biotech industry.10

When writing about Vial, I shared Peter Thiel’s view that the only two types of companies that have reliably captured value from new inventions have been vertically integrated complex monopolies and software businesses. For biotech, the two winning business models so far seem to be selling drugs or tools. Over time, we’ll fill in this chart by analyzing businesses selling new types of vertical bioproducts, and others pursuing new types of horizontal business structures.

The impact of a tool can be profound. Rather than producing a single new medicine, Illumina serves as a force multiplier for biomedical labs and companies around the world. Biological research has been irreversibly transformed by ubiquitous nucleic acid sequencing, and we’ve just started to scratch the surface of the clinical applications of genomics. This infrastructure will persist across generations.

In retrospect, we’ve used Hamilton Helmer’s 7 Powers framework to explain why Illumina was able to achieve the market dominance that it did. Importantly, genomics turned out to be a really big market. This is another lesson to be learned from studying Illumina: a successful biotech tool needs to solve a nearly universal problem. Practically every biologist cares about answers encoded in nucleic acids. Pouring capital into R&D and commercialization for a niche tool with few potential users will make it exceptionally difficult to recoup costs and produce impressive returns.

While Illumina represents a category-defining horizontal biotech outcome, the company has always had a relentless focus on producing their own form of vertically integrated product. Affymetrix, Illumina’s initial competitor in the DNA microarray market, attempted to follow the Intel playbook. They wanted their chip in every other product on the market, and were content with other companies emerging to produce instruments, reagents, or analysis tools. Illumina wasn’t. The goal was to own every single aspect of the product experience in order to move faster and deliver superior results. This is much closer to the Kodak business model—sell the camera and the film.

Many of these hard-earned lessons can now be seen on display in the more recent ventures of the original Illumina founders. Mark Chee has gone on to found Encodia, a business aiming to transition biomedical research from nucleic acid measurement to protein measurement. Chee says, “Our aim is to deliver a system that enables researchers to probe the immense complexity of the proteome routinely and at a scale that was previously unattainable.” Again, the goal is to build a highly scalable research tool that addresses a widespread unmet need.

After leaving Illumina, John Stuelpnagel has held board roles at several leading tools companies including serving as the Chairman of 10X Genomics since 2013. 10X has emerged as the dominant provider of single-cell sequencing technology—a revolutionary tool for deciphering complex gene expression programs in tissues and organisms. One of the major differentiators for 10X has been its focus on crafting a deep integration between reagents, instruments, and downstream analytical software tools.

Beyond providing valuable strategic lessons for future inventors and entrepreneur’s, Illumina has cemented itself as a generational leader at the intersection of technology and biology. From their original fiber-optic bead arrays to the commercial launch of the first sequencing-by-synthesis instruments, Illumina helped to strap biotech’s trajectory to the rocket ship of the digital revolution. Now, the two industries will be forever intertwined. As Jay Flatley put it,

If last century was the informatics technology century, I think this is the century of biology. It’s an absolutely explosive field. There’s incredible opportunity to explore a new space, and to create startup companies that innovate around human and plant biology.

I also think that technology and biology are intersecting in very interesting ways, with Illumina being a clear example. We’re really a technology company, but every application of our technology is directed at understanding biology. I think that point of interface takes people who have the ability to have a foot in both worlds, and so I think that’s an incredibly interesting place to be.

I couldn’t agree more—and we’re only in the early innings. There’s so much left to build in order to usher in a vibrant and verdant future worth living in. By studying the stories of the generational businesses that came before us, we can act with more clarity.

Onward. 🧬

Thanks for reading this essay about Illumina’s path to Power. Thanks to Tony Czarnik and John Stuelpnagel for sharing some of their memories and insights from their time at Illumina.

Note: an earlier version of this essay has been updated to correct initial discrepancies in the financing history of the company sourced from PitchBook.

If you don’t want to miss upcoming essays, you should consider subscribing for free to have them delivered to your inbox:

Until next time! 🧬

Here, I’m referring the Earth Biogenome Project, and the Human Cell Atlas project.

In many ways, their launch couldn’t have had better timing. The International HapMap Project to catalog patterns of human genetic variation also started in 2002.

The story of Celera Genomics is worth exploring. To this day, Craig Venter remains a controversial visionary on the frontier of genomics and synthetic biology.

Ultimately, this turned out to be the peak of the first hype cycle for genomics. The company lost steam, and ended up being acquired by Celldex for $94.5M.

Jonathan Rothberg is still actively inventing technologies and building new biotech companies. Ashlee Vance covered Rothberg’s efforts to develop rapid COVID diagnostics while sailing around the world on the Gene Machine, his personal yacht equipped with a molecular biology lab. Truth is stranger than fiction, and genomics has never been short of incredible characters.

The Panton Arms is located a mile away from the pub where Watson and Crick first had their crucial realization about the structure of DNA. Clearly, pubs in Cambridge host some interesting scientific discussions.

One of the major advances was to design a chemistry protocol to create clusters of clonal copies of the DNA fragments on the solid surface. This helps for detection and sequencing accuracy. Illumina has a great video of this here.

This framework also helps explain Illumina’s extremely litigious history. They’ve been involved in a number of lawsuits, including continually challenging BGI’s entry into the American genomics market. Intellectual Property is a Cornered Resource that is defended in court.

I’m using the word platform here in the way that technologists use it—not biotechnologists. Most people in biotech use the term to describe a therapeutics company with a competitive technology that opens the door to the development of multiple therapeutics. This back and forth can be seen in a dialogue between Jeff Tong and Steve Holtzman where Illumina comes up.

Some of the largest life science tools providers existed before Illumina, such as Thermo Fisher, which is a $200B company. Another example is PerkinElmer, which ultimately bought Applied Biosystems. I view these as analogs to the large pharmaceutical companies. Before Illumina, there weren’t examples of venture-backed tools companies that quickly achieved enormous scale.

Thanks for weaving together all these details into an interesting narrative about Illumina's rise!

Always been curious about this rise